Sea Limited: An impressive quarter

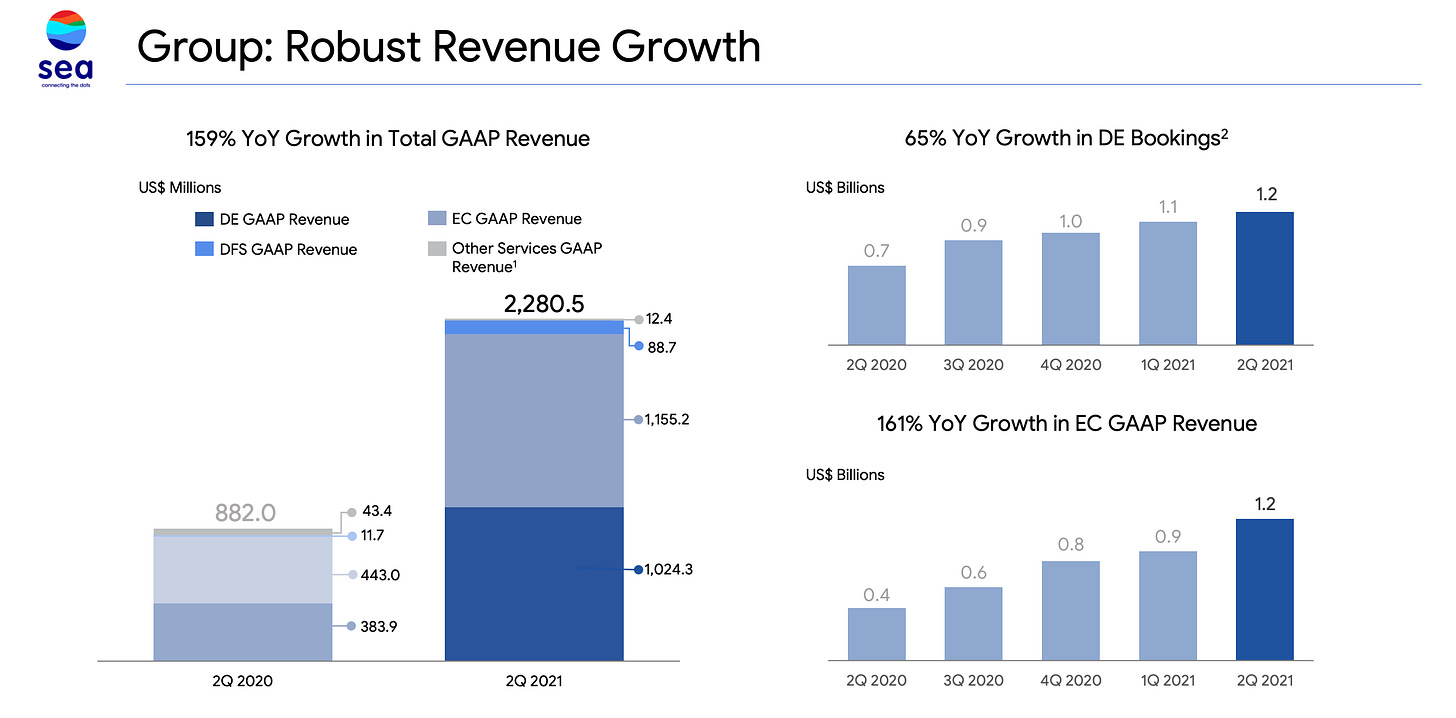

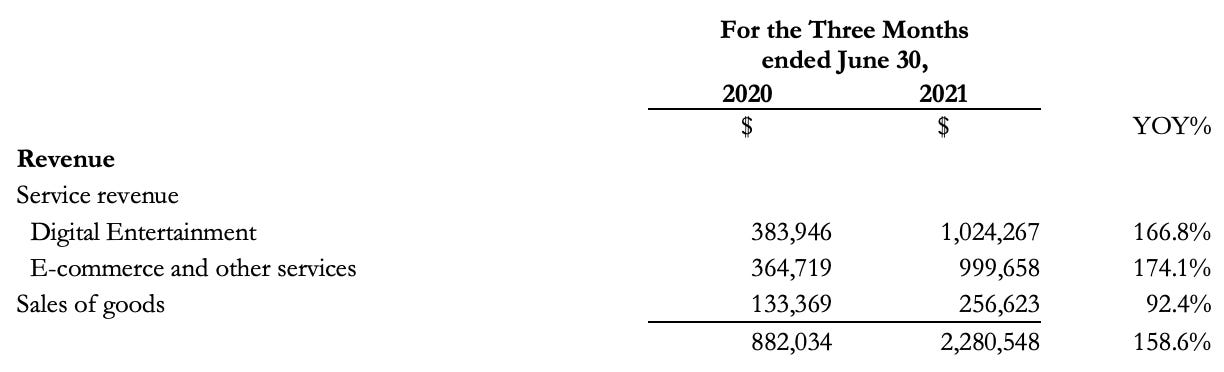

Right off the bat, Sea turned in a really impressive June 2021 Quarter of growth with Garena growing 166.8% and Shopee growing 174.1%.

Garena & Self-funding

One of the really interesting things that made me look deeply at Sea in the first place was the model of funding Shopee internally with a really profitable gaming division in Garena. It occurred to me that this was Amazon and AWS, except in reverse chronological order. How interesting.

You can see in the image above from Sea’s June 2021 quarter results that Garena did 62.8% in adjusted EBITDA. I would use “self-funding” with some caution though, because while Sea is using profits from Garena to invest in Shopee, it’s still raising money by selling shares on the open market. Here’s what their share count looks like over time:

Still, I see this as an advantage as Sea is able to use their $175B market cap to their advantage in raising money. Funding Shopee through a combination of Garena’s profits and selling shares is rational and difficult to compete against. Here’s a Twitter thread with a conversation around this idea:

Some questions

1) The “boots on the ground” approach to South East Asia by Sea Limited is in some ways a source of moat, especially with regards to Alibaba/Lazada, but also a source of questions for me. For one, the cultures of each of the countries they operate in are completely different. Who’s to say a challenger that is deeply entrenched within a country doesn’t give Sea a run for their money there? Do the network effects usually born out of leading e-commerce platforms survive country lines over the long term? Who knows?

2) Is Sea spreading themselves too thin by thinking about LATAM — specifically Brazil — with formidable competitors in MercadoLibre, especially now given the markets they operate in are still in infancy? Why not focus entirely on South East Asia? Again, who knows.

3) What gives me the most pause about Sea is the profitability of Shopee, a marketplace that should eventually exhibit some good economics. We are nowhere near that right now, though.

The gross profit for Shopee in the June 2021 Quarter was roughly 18% (!!). To give you some perspective, Etsy and Ebay, two other marketplaces albeit in different markets, each have a 70%+ gross margin. It’s clear that Sea is coming off of a very high fixed cost base, but even more so that it is subsidizing Shopee with free shipping and other customer incentives.

There are some silver linings:

Also, on a consolidated basis, Sea’s gross profit margin has also gone from negative to over 40% in 2 and a half years.

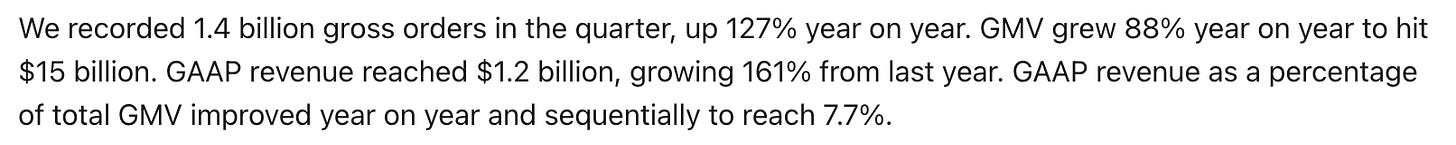

Sea’s take rate has also gone up and is 7.7% now.

Sea is attributing the increased take rate to the advertising and marketing by companies on the Shopee platform.

The stock

The stock is now trading over $320 a share, which a P/S of around 24, expensive on a historical/relative basis, but *maybe* on an absolute basis as well.

It’s a roughly 11% position for me, but I haven’t added recently and my cost basis is $161.71. I plan on holding my shares.

Valuation

I don’t really do detailed models and DCFs, so most of my valuation is back of envelope type. If you assume a 43% 5-year revenue growth, and a 17% net margin at maturity, the IRR is around 10%. Of course, I could be wrong on all of those assumptions. Investing is hard.

Feel free to leave some feedback and anything you think I should correct/add. What do you think of SE stock at these levels?