Portfolio updates and general thoughts (March 11, 2021)

It’s been a while since I’ve written a long-form post about my portfolio and general thoughts, so here goes:

How I’ve Changed

As many of you know, there’s been a dramatic shift in my thinking around portfolio construction. Heavily influenced by Buffett and especially Munger, I once swore by concentration, and one of my previous blog posts elaborated on my (previous) thoughts on it: https://liviamcapital.substack.com/p/how-i-approach-portfolio-construction

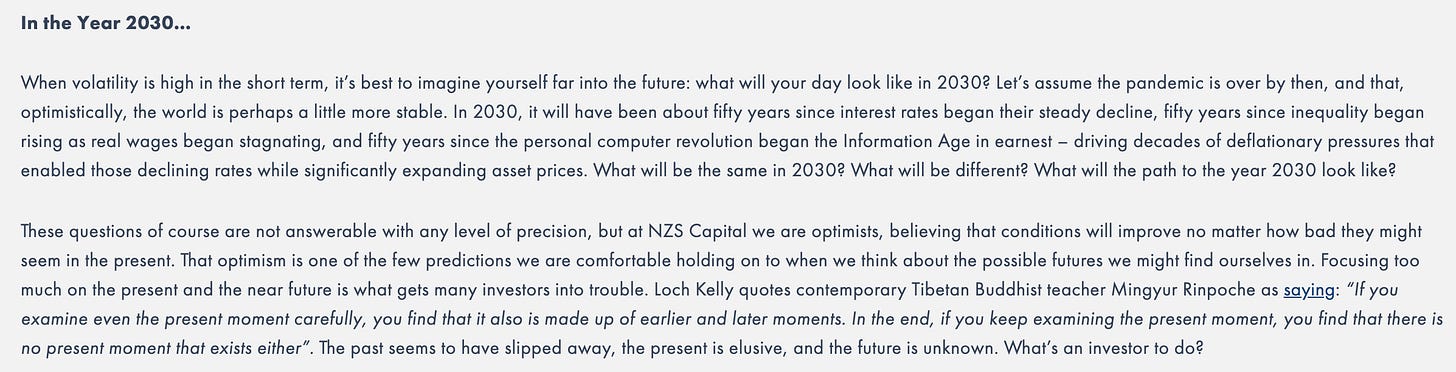

A few months ago, I read a paper written by Brad Slingerlend (@bradsling) of NZS Capital and as I was reading it I could feel my mind change; it was a formative moment for me. It challenged everything I thought I knew about investing and made me consider that my previous concentration mandate was non-optimal, especially in these dynamic times.

I highly recommend reading the paper here but essentially it recommends having a portfolio split into two halves; the first with a few resilient & optional businesses and the second with many smaller optional-only positions, while squeezing out the resilient-only businesses. As a result of reading this paper and thinking through its ideas, my portfolio went from 5 positions to over 25.

Portfolio Update

Selling Datadog, Crowdstrike, Snowflake, JFrog, and Cloudflare

I recently sold out of Datadog and CrowdStrike, both of which I still think are phenomenal businesses. Datadog has a large opportunity in observability and APM and its growth is highly correlated with public cloud growth of AWS, Azure, and GCP, which we all know has a very long tailwind. Crowdsrike is a leader in endpoint security which should also benefit in the next decade. There’s no doubt both businesses will be highly cash flow generative in due time. The issue is valuation.

You can see in the chart above that Salesforce IPO’d in 2004 (approximately 17 years ago) at a ~$4/share and ~16 PS and has returned about 29% annually since then or almost 55X (!!), a phenomenal performance. Well, Datadog is trading at a 45 PS and Crwodstrike is trading at 58 PS. You might say, well 55/3 means Datadog would still return 18X in 17 years (~20%). Sure, but that’s only if either of those does as well as Salesforce has for 17 years.

I also sold out of Snowflake, JFrog, and Cloudflare. I like all of these businesses but I’m trying to get supernormal returns, and in my opinion, those businesses promise average returns at best. At the right price, I would certainly be a buyer again.

Recent adds:

Wix, Twitter, JD, Tencent, Baba, Etsy, & 4477 (Base Inc)

Wix:

Wix payments grew 382%, a clear indication of “ROOTMO” given Wix is trading at 16 P/S. Credit @bradsling for the idea of ROOTMO: “resilience + out of the money optionality”.

Twitter:

My hangup with Twitter has always been around monetization. Advertising is a difficult business without scale, especially at the top of the funnel. Well, Twitter recently announced Tipping and Super Follows which will help users monetize their Twitter accounts, hence creating a flywheel of more engagement -> MAUs -> Advertising revenue, etc. Twitter expects revenue to double in three years and the valuation is not demanding. It’s also good to see Twitter moving fast and having some success with new products like Spaces, a Clubhouse clone.

JD:

A Chinese e-commerce powerhouse trading at a very reasonable valuation with two things that I like: 1) exploding EPS and 2) tons of optionality with JD Health and JD Logistics, etc:

Tencent:

WeChat is ubiquitous in China, and Tencent’s core business of gaming, media, advertising, and cloud is formidable. Their investment portfolio may be equally impressive, however. It’s a remarkable business in so many ways:

Alibaba:

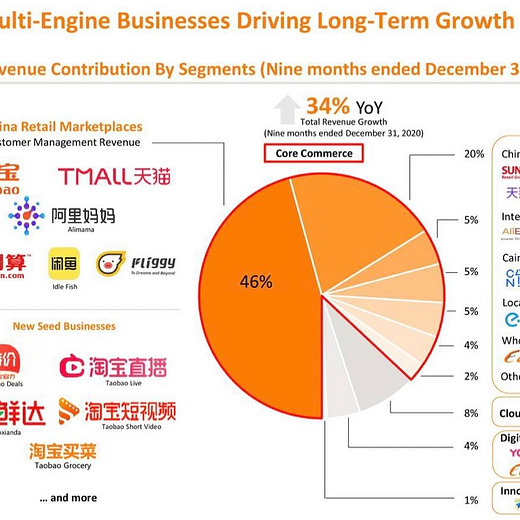

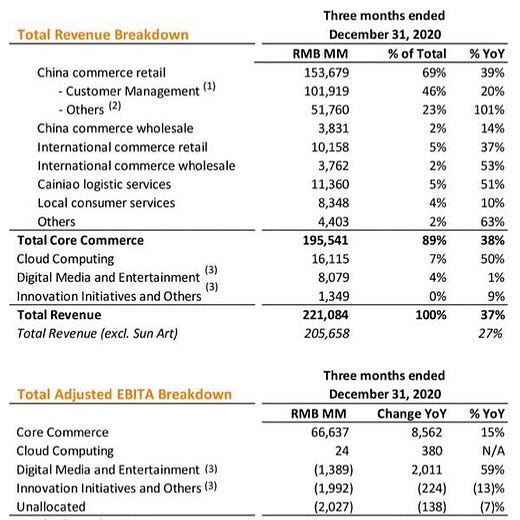

A wide moat business growing at 34% with a very undemanding valuation of 26 P/E. Lots of optionality with e-commerce and cloud:

Etsy:

I highly recommend reading John Huber’s thesis on Etsy in the Graham and Doddsville newsletter:

4477 (Base Inc):

This is my second investment in a Japanese business, my first being Mercari.

Thoughts on interest rates and inflation:

I’m certainly not an expert on marco-economics (or anything else for that matter), but I found this paragraph from NZS Capital to be useful in helping me shape my thinking around rates, inflation, and the future:

https://www.nzscapital.com/news/nzs-capital-q4-2020-update

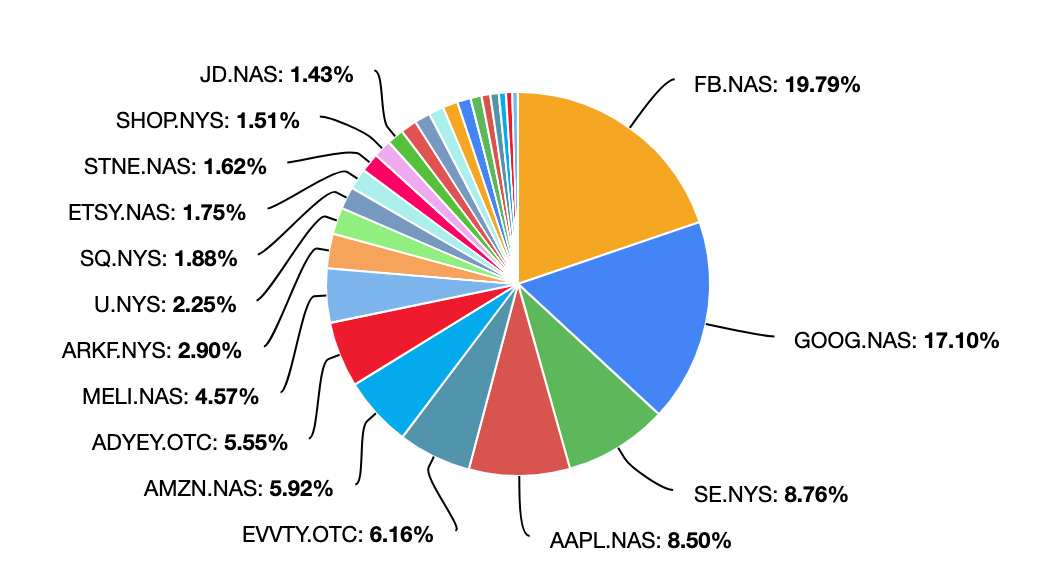

My current portfolio:

These are businesses I love right now, but I change my mind daily. I highly recommend you do your own due diligence. You will not be able to copy conviction.

Thanks for the post! Curious - given the continued drawdown since this was written in March, at what point to names like SNOW, NET, CRWD become interesting to you again? For me, SNOW remains a high-conviction position and one that I'm happy to own for the next decade without repositioning. Really trying to get your thoughts on investing for the long-term vs catching a falling knife (which is something I've become quite good at recently!)

Nice moves. Though arguably you could have larger stakes in Tencent, BABA etc, as they are certainy more resilient. ( not counting for the chinese government risk)